Report Summary

Period covered: 05 October - 01 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Retail Sales Performance:

Retail sales growth rose by xx% year-on-year in October according to the Retail Economics Retail Sales Index, compared to a three-month average of xx%.

Factors impacting the headline performance in the month include:

Mild weather: One of the dullest Octobers on record with very little sunshine, the month opened and closed with stormy weather with a gloomy, stagnant and mild middle period. The warmer-than-average temperatures meant seasonal sales in categories such as clothing and footwear were off to a slow start.

Lower footfall: Data from MRI showed store visits were lower than last year, including an xx% fall on high streets in footfall YoY during half term. Retail parks and shopping centres did better, helped by family outings and evening leisure trips, but not by enough to lift overall footfall.

Discretionary spend pushed back: Many households held off on toys, electronics and winter apparel purchases amid plans to wait to buy during the Black Friday promotional period.

Budget caution: Speculation around changes to taxes, public spending, and income led to increased consumer caution during the month, with many holding back on spend ahead of possible changes to their financial situation. The budget and Black Friday combined to create a ‘wait and see’ atmosphere during the month.

Home-related boosted: Furniture, homewares and home improvement had a better month than other discretionary categories, as shoppers prepared homes for Christmas, engaged in seasonal refreshes, and used the mild weather for gardening and DIY projects.

Underlying uncertainty

Overall, retailers entered Q4 on a relatively fragile footing, beset by caution and uncertainty after a year of continued high inflation.

Some retailers began running early Black Friday sales in a bid to bring sales forward, attempting to entice shoppers who were delaying their spending.

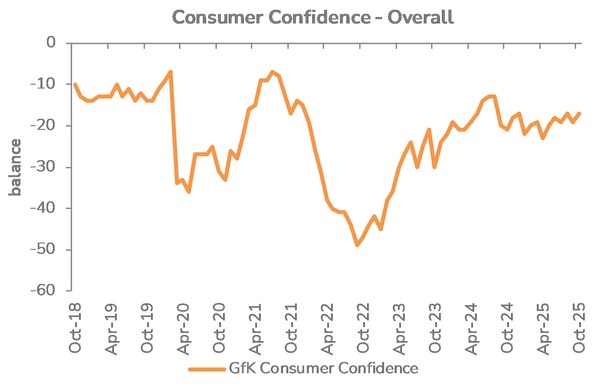

Consumer confidence showed conflicting signs in October, with the headline rate rising two points to -xx, which included a xx rise in the major purchase index as shoppers warmed up for Black Friday. However, confidence in household finances remained unsteady, with the continued elevated cost of living remaining on the list of consumers’ worries.

The Bank of England held the base rate in November at xx%, remaining cautious and emphasising the need to continue tackling inflationary pressures.

Inflation eased to xx%, down from xx% in October as energy prices cooled slightly. The Bank of England expects inflation to fall to xx% in 2026 before reaching its xx% target in 2027.

Food inflation remains a particular pressure. While Kantar reported an easing in food inflation to xx% in October, the lowest level in over a year, the category continues to take a larger proportion of household budgets than it did a year ago.

In October, the impact of this was compounded by the approaching Autumn budget and the threat of changes to taxes and disposable incomes.

Category impact

Category performance remained mixed, with most impacted by consumer constraint ahead of November’s sales events. Some fared better than others, with home categories boosted by pre-winter updates, and with food faring better than non-food.

- Clothing (+xx% YoY) and Footwear (-xx%) had a quieter month as consumers held back.

- Health & Beauty (+xx%) continued to perform better than other non-food categories, although growth has slowed from xx% a year ago.

- Homewares (+xx%) and Furniture & Flooring (+xx%) benefitted from seasonal refreshes.

- Electricals (-xx%) saw strong value-driven behaviour and postponed purchased as consumers waited for sales.

- Food values held up better than non-food (+xx% vs +xx% total non-food). However, growth remained price driven rather than volume-driven.

- Kantar reported grocery inflation easing to xx% in October, the lowest level in over a year, as retailers started introducing early festive deals to help consumers manage costs ahead of the Budget.

Take out a FREE 30 day membership trial to read the full report.

Confidence improves in October

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK